Car Insurance at Fault Driver Is Responsible for

After a car accident, insurers try to figure out which driver was at fault. This can affect the amount of the insurance claim payout, but fault can be hard to prove. We'll cover how your state influences how your insurer determines fault and how you can prove your innocence after a car accident.

- Fault vs. no-fault states

- The 3 types of negligence

- How to determine fault in a car accident

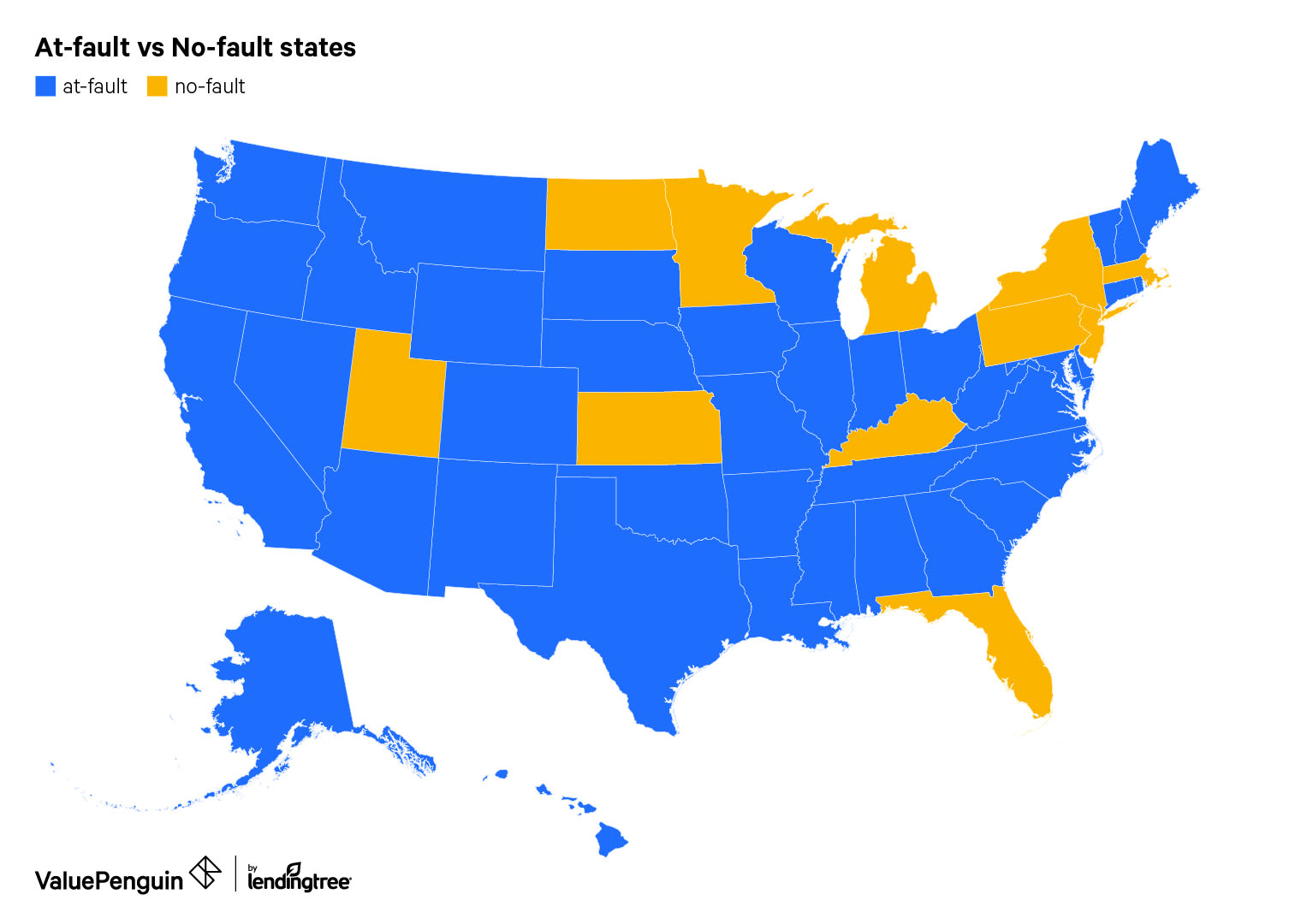

Is your state a fault or no-fault state?

In states that assign fault — which make up the vast majority — the person who caused the car accident would have to pay for damage. That person's bodily injury (BI) liability insurance will pay for the other driver's medical expenses, and their property damage liability would cover the other driver's car repairs. The extent of the payout will vary by state.

In "no-fault" states, drivers must carry personal injury protection (PIP) insurance. This type of coverage pays for medical expenses after a car accident, no matter who was at fault. The drivers also won't need to file a claim through one another's insurance, which saves time and energy. The downside of PIP, however, is its cost. In our table below, you can see which states are fault and no-fault states. Even if a state is not a mandatory PIP state, you can still acquire PIP insurance as an optional coverage.

The 3 types of negligence

In the car insurance world, negligence indicates fault. If you're negligent in a car accident, you are at fault. There are three types of negligence: pure contributory, pure comparative and modified comparative. Even with a PIP policy, you may exhaust coverage and would need to file a claim under the other driver's BI insurance. This process differs by state because each one defines negligence differently.

Pure contributory negligence

With this type of negligence, the insurance company will only reimburse a driver if they're completely blameless in the car accident. If the other driver can prove you played even a small role in the accident, then you aren't eligible for an insurance payout. Only four states and the District of Columbia adhere to this type of negligence.

For example, say you get into a car accident in North Carolina. Someone rear-ended your car, and the cost of repairs costs $1,000. Usually, it's easy to assign fault to the person who rear-ended your car. But if that driver can prove you were trying to beat a yellow light and then suddenly stopped, for example, you may be partially at fault. In this case, you won't get paid for any of the damage.

None of these states are mandatory PIP states, and it's rare to have an accident where no one is at fault. Therefore, it may be in a driver's best interest to have some PIP protection in these states.

Pure comparative negligence

With this type of negligence, a driver's payout is based on a certain percentage of fault. Twelve states use this type of negligence, and three are "no-fault" states. An obvious pitfall of this type of negligence is determining the exact percentage of fault.

Let's say you get into a car accident in New York and the damage costs $1,000 to repair. The insurer determines you were 75% at fault. You could file a claim for up to 25%, or $250, of the settlement from the other driver's insurance.

Modified comparative negligence

This type of negligence also considers the proportion of a driver's fault, but it sets a threshold, usually 50% or 51% depending on the state. More than 30 states follow the modified pure comparative negligence model. South Dakota has a similar system called "slight/gross negligence," which doesn't use percentages. Instead, an at-fault driver cannot get a payout unless they are "slightly negligent."

Let's say you were involved in an accident in Georgia that causes $1,000 in damage. The court determines you were 45% at fault and the other driver was 55% at fault. With modified comparative negligence, you can recoup 55%, or $550, of the settlement from the other driver. But if you were found 55% at fault, then you would be entitled to nothing.

How is fault determined in a car crash?

Proving fault can be difficult with just anecdotal evidence. But it can be the difference between getting a payout and getting nothing, and it can impact getting cheap auto insurance in the future. When a driver is at least 50% at fault in a car accident, insurers typically increase your car insurance rates.

You can use certain resources to prove your innocence or prove the other driver's fault.

Police reports

When police are called to the scene of an accident, they create and file an official report. It contains an objective analysis of the situation, including an opinion on who was at fault and whether drugs and alcohol were involved.

State laws

Learning your state's traffic laws can help you find out if some of the blame falls on the other person involved in the accident. Check your state's motor vehicle website, your local DMV or your local public library.

Many traffic laws seem straightforward but actually have nuance. For example, if your car hit someone riding a bicycle, it may seem like you're 100% to blame. But traffic laws might say bicyclists have to stay in a specific part of the road. If you can shift some of the blame to the other person based on your state's laws, then you might save money in a traffic court case.

Final thoughts

After a car accident, it can help to call the police and have an officer file an official report. You should also check out your state's negligence policy and traffic laws. Each state has its own system of assigning fault, but knowing how it works and how to prove your innocence can help you make sure you get a fair insurance payout

Car Insurance at Fault Driver Is Responsible for

Source: https://www.valuepenguin.com/fault-or-no-fault-accident-decision-affects-auto-insurance-claims